Few insurance brokers are willing to disclose how much they make from their clients’ accounts. Perhaps they don’t believe they do enough work to deserve the money they receive for helping their clients. Personally, the last thing I review with my clients in our mid-year reviews is Broker Compensation. I want all of my clients […]

By now, you should have a good idea of how the Affordable Care Act (ACA) has impacted your company’s health insurance plan. For those employers benefiting from the ACA, we’ve seen consistently low premiums from United Healthcare. For employers facing higher premiums and less benefits from the ACA, we’ve seen more and more options from […]

Any insurance carrier selling health insurance plans in the state of Kentucky to employers with 50 or fewer employees, must have their rates approved by the Department of Insurance. These filings are public record and found on the DOI website. Employers can use these filings to get an idea of what their next insurance renewal […]

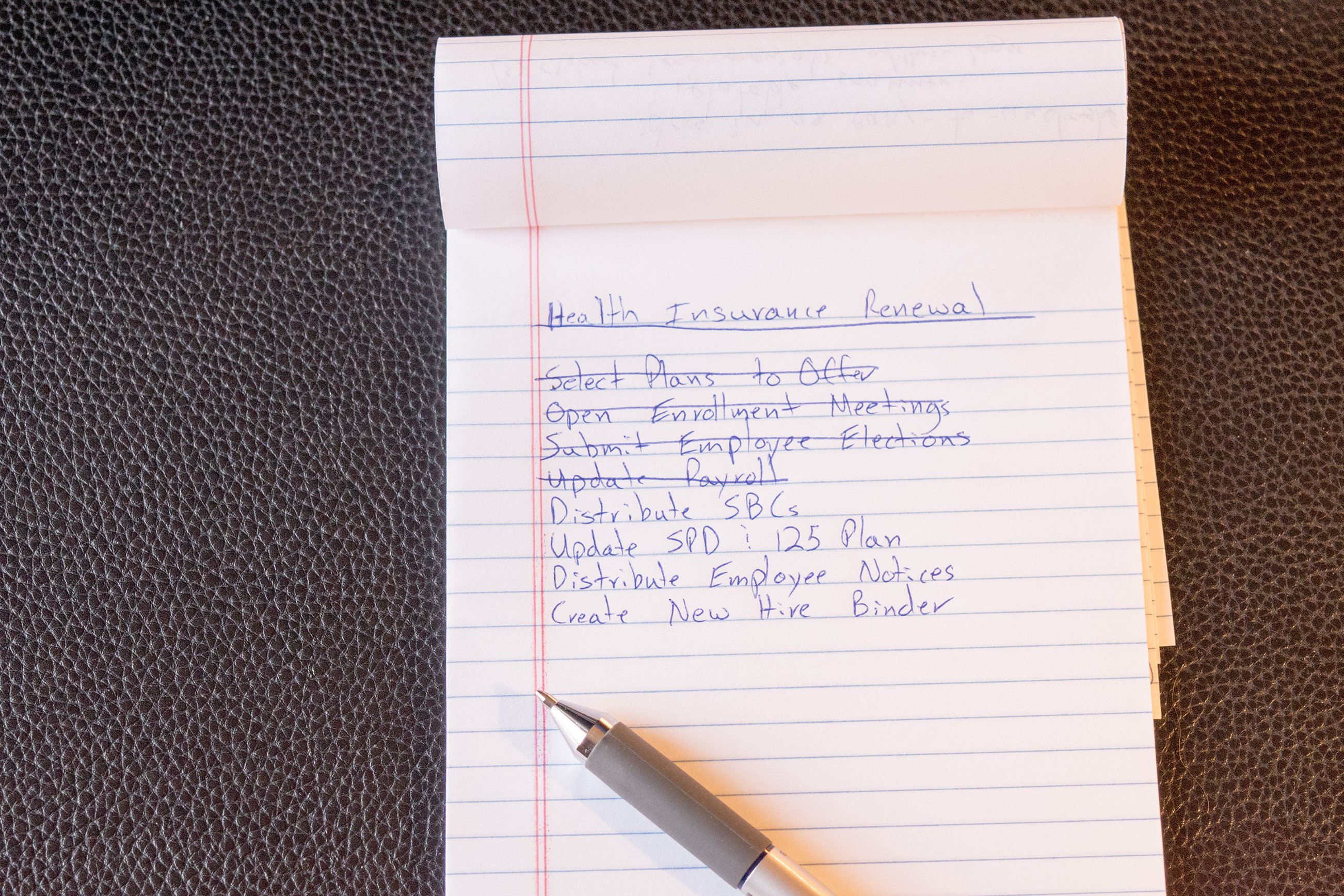

Health insurance renewal season is stressful for everyone involved. It is particularly stressful for employers. They have to select carriers, plans and benefits, educate their employees, and collect an overwhelming amount of paperwork within a very short window of time. Over the years, I’ve found that using a custom checklist with my clients helps […]

[spb_text_block pb_margin_bottom=”no” pb_border_bottom=”no” width=”3/4″ el_position=”first”] The Benefits of Small Business Health Plans over Individual Plans Small businesses often ask me how a small group health insurance policy is better than an individual plan. In this article, I want to highlight the 4 biggest benefits to employees from buying insurance through a group plan […]

Effective Employee Benefit Communication Strategies for 2018 Let’s face it, we are more distracted today than we’ve ever been. So, how do you educate your employees on what your benefits are, how they work, and how to most effectively use them? Here are a few ideas on how to connect with employees […]

Worksite Wellness 101 for Small Businesses Small businesses make 2 big mistakes with workplace wellness: They don’t do anything at all They go overboard and make their employees hate wellness A better strategy for small employers is to start small and ease your way into wellness. Just as a baby has to crawl before […]

Small Business Post-Enrollment Health Insurance Compliance You made it through another health insurance renewal! All plans are in place, your employees are enrolled, and ID cards in their hands. While you may have a sense of relief, you still need to complete a few compliance tasks before totally forgetting about your benefits program. […]

[spb_text_block pb_margin_bottom=”no” pb_border_bottom=”no” width=”3/4″ el_position=”first”] How your small business could benefit from a Level-Funded Health Plan For years, large employers with over 100 employees have taken advantage of the many benefits to offering self-funded health plans: Lower taxes Avoid state insurance regulations Benefit from savings on lower claims than the carrier’s pool Small […]

[spb_text_block pb_margin_bottom=”no” pb_border_bottom=”no” width=”3/4″ el_position=”first”] How Association Health plans work Anthem has been offering Association health plans in Kentucky since the 1970’s. Recently, other carriers have entered this market as a way to allow small businesses to bypass the high costs of the Affordable Care Act (ACA) / Obamacare. What is an association […]